|

Financial Statement AnalysisFinancial statement Analysis-IFinancial Statement Analysis is a very important job of an analyst as it will cover the company from 360 degrees and none of the aspects left untouched. Many of us have the myth that only accountancy background people can work over it but it's not true as you have to study the readily available reports, you don't have to prepare these statements so there is no need for similar background. You are the user, not the maker and the user can be anyone as similar that we use so many websites and applications in our system which we can easily use just after learning once or twice without thinking much about its backend process. We will study these statements here as an Investor's point of view, not from the company's point of view. We will understand all the parts of financial statements which we should evaluate while analyzing the financial position of the company, this makes us double sure that we are investing in good business. It would be divided into two parts in part-I we will be discussing P&L statements and the Balance sheet while in Part 2 we will discuss Cashflow statement and ratio analysis. There are three main parts of financial statements that a company showcase to represent its position: a) Profit and Loss Statement b) Balance sheet c) Cash flow Statement d) Ratio Analysis Profit and Loss StatementAs the name suggests, this provides you the information about Profit and loss-making statements of the company as well as summerise you about the revenues, cost, and expenses incurred during a specified period of time, say a quarter or annual. P & L statement tells us about the ability of the company to deal with its future challenges and competitors. Reasons to study P & L statement

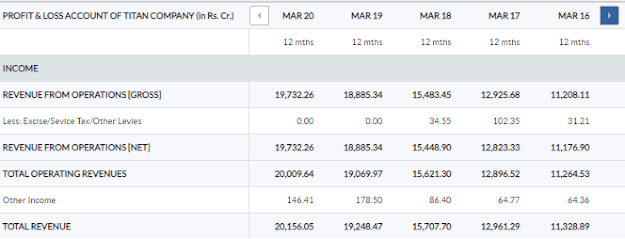

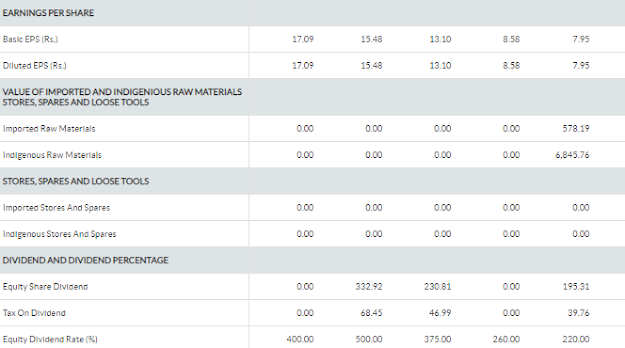

We will check all the things with a real-time example, taken the P&L statement of Titan company, we will take income and expenditure figure one by one for better understanding. I have taken the below statement from Moneycontrol.com and we will also learn here that how to operate these reports in money control website First of all, it is mentioned that all the figures are in crores. The annual statement is given for 5 years while we can compare for another 5 years also by clicking on the arrow at the rightmost corner we can see in blue. Now, the first head in Income is Revenue from operations which implies the company revenue coming from its all operations which we can see is continuously increasing year on year so this is good. The next head is Total Operating Revenues which implies revenue generated from the companies primary business activity, this is also increasing year on year. Then we come to Total revenue which is also increasing year on year now we will see the expenditure part of this statement: Here we need to check directly the what are the numbers in total expenditure if the figure is increasing year on year then we need to check that in which head it is increasing and vice versa because if sales will increase then automatically raw material, operating cost and some other expense would also increase simultaneously. while Profit/Loss before tax should increase year on year and after that Profit/Loss after tax, it is the figure which comes after paying all the taxes to the government. Please note that sometimes the Profit/Loss figures would be much more or less than expected due to tax adjustments so check for it while making a finalized decision over any stock. After checking above P&L we can give thumbs up to proceed further. Thereafter P&L gives us information like EPS(Earning per share), dividend history, etc, check below for reference: Read more about EPS, well explained in context to Price to earning ratio(P.E Ratio). A higher EPS means that the company is profitable enough to pay more to its shareholders, it indicates more value in the company. The last is the Equity share dividend which can tell about the dividend distribution history to the shareholders of the company. Balance SheetsP&L gives you the information about pertaining Profitability of the company while Balance sheets tell you about pertaining to the assets and liabilities and the shareholder's equity. It is a mirror that reflects the true position of assets and liabilities on a particular date. Assets are of two types tangible and intangible. Liabilities, on the other hand, represents the company's obligation, as the company thinks that this obligation has the economic value in the long-run. In all the balance sheets, asset side column should be equals to liability side column. Further, Shareholder equity or owners capital = ASSETS-LIABILITIES Now, we will see the balance sheet of the Titan company to understand its operationality in detail: I have taken here the liability section of Titan Company and here first head we see shareholders funds which specify the amount of equity into the company if shareholders equity is positive then a company has enough assets to pay its liabilities. The next line is Reserves & Surplus, it is a part of owners' equity or accumulated profits that a company earned and retained over time. Retained profits are those which the company remains with after paying dividends to shareholders. Reserve and surplus increase if the company reinvests their retained profits into the company which we can see in the above balance sheet. Total Shareholder's funds=shareholders fund+reserves and surplus There are two types of liabilities Current and non-current liabilities, Current are those which are due and payable within 1 year and non-current are long-term liabilities. The important thing to notice into the liability section is short-term and long-term borrowings which will tell you about the debt of the company carrying with. Provisioning is another important term in the balance sheet to be checked. Provision is the amount set aside to pay the probable future expenditure. The increase in provision tells about the uncertainty hitting in the future and it can affect the profitability of the company in the near-term. Now we will check the asset side of the balance sheet: As we already discussed tangible and intangible assets, the next is Capital work in progress represent the cost incurred on a fixed asset which is under construction till the date of the balance sheet prepared. Non-current investments are the companies long-term investment for which the full value would not be realized within 1 year of time. Eg that the company invested in any other company/property/plant or equipment. Inventories are a very important aspect an analyst should aware of as an increase in inventory would be a risk for the company because having too much inventory in the balance sheet inherit the risk that the product will become absolute or company will not be able to sell the excess of inventory. There is one more risk of spoilage of inventory if company unable to sell it at the right time. At the time of analyzing inventory we should try to check the conditions that why there is a high inventory with the company because there can be issues like high product pricing, an increase of competitiveness, change in taste due to technology up-gradation, or fashion, etc. In the above balance sheet of Titan, we can see that every year the inventory is increasing so it might be the increase in the price of gold/change in fashion/increase of competitiveness in the market/better products available in the market at the lower price range. Trade receivable arises when the company sold its goods and services on a credit and its an asset because it is to be paid fully within 1 year of time. Cash and equivalents are the items that are either cash or items that can be easily converted into cash as and when required. Short term loans and advances are the loans and advance which the company has paid early but it will be realized at a future date so it will be treated as assets. You can get all these data readily available on many websites while I personly trust Money control to check all this information. Follow the below steps to reach this information in money control.

Here you will find all the information related to the financial statements of the company. After checking this much information you can get a good idea about the company's financial stability. As important it is to do the financial analysis of the company the more important it is to listen to the commentary of management in every quarter after the issuance of the annual report. The company's management always reports their commentary after issuing their quarterly or annual results in which they specify everything very precisely which helps the investors to correlate it with the financial statements provided while deciding to retain their interest with the company or not. |

Do you know your investment! Do you know your investment ! Investing is not only about money, but it is also about your emotions and hard work. If your investment is not fruitful and rewarding then you would not be motivated to do more hard work. A good and successful investment is like another earning member in your family who will take up your money, make your money work, and give you long-term returns. Investment is like buying today and consuming tomorrow, with an increase in quality and quantity. In other words, protecting our future and creating wealth. The purpose and meaning of investing can be different from person to person and profession to profession. Like the person earning 50k in a month, would be having a different investment objective, then the person earning 25k. Even their responsibilities would also play a vital role in investing, depending on their conditions, maybe the person earning 25 k is not having any major responsibilities while the person earns 50k ...

Thank you

ReplyDeleteVery nice blog

ReplyDeleteVery nice blog

ReplyDeleteThis is the detailed study of financial analysis I,to check the datas given by a company in accounts for quarter to quarter & year to year .we should go through with atmost care in result we found it is clear to invest in or not.

ReplyDeleteAwesome .

ReplyDeleteNice

ReplyDeleteNice article!! Thanks for sharing amazing article I was also searching for Financial Analysis. and your article really helps me a lot.

ReplyDelete