|

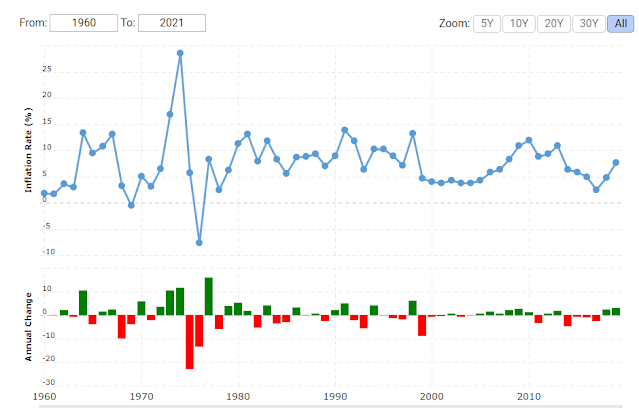

InflationInflation MeaningAs the word itself is explanatory inflation means inflate in the price of goods and services in a specified period of time. In other words, Inflation is the measure at which the average price level is increasing of the goods and services in the economy and the buying power of the common man decreases with the same levels. While this is applicable for the whole nation not only the common man but if the person is an entrepreneur and dealing with the raw material and heavy plants and machinery, somehow they can pass on this inflation rate to their customers but for the common man they cannot pass on this to anyone. This rate is not fixed and keeps on changing year on year so it also requires the need to evaluate and changing your investing portfolios year on year in spite of being constant. Changing trend of inflation rate over the yearsIt is not sure that inflation would be also in a positive trend, sometimes it is in a negative trend also, we will check one graph for full understanding: Please note that the above graph and date have been taken from macrotrends.net Here we can easily analysis that the inflation rate is fluctuating year on year depending on the economic condition, In 2016 the inflation rate was 4.94% a decline of 0.93% from 2015, In 2017, the inflation rate was 2.49 % a decline of 2.45% from 2016, In 2018, the inflation rate was 4.86%, an increase of 2.37% from 2017, In 2019, the inflation rate was 7.66%, an increase of 2.8% from 2018. Factors that drive inflationThis is very important to know what all are the factors that drive inflation. Inflation can occur on every product or service due to its impact on demand, increasing fixed costs, decreases in demand, etc. Who monitors inflation?Central banks of developed economies, including the Federal reserves, monitor the inflation, They adjust the monetary policy accordingly to adjust inflation if price fluctuations increases. Inflation is of great concern nowadays as it can make the savings of general people less valuable in coming future due to increasing the cost of the products and services and decreasing the value of money. Factors affecting the inflation rateThere are 3 major factors which drive the inflation rate:

Cost-push inflationCost-push inflation occurs when the cost increase to products goods and services, it can be due to any reason but its impact on the cost of machinery, raw material, labor. If the demand for one product is depended on another product for which the prices are continuously increasing then also it will be cos-push inflation. Demand-pull inflationAs the name suggests demand-pull inflation occurs when there is an increase in demand for one or more product due to any of the reasons: Increase demand due to more money left with the consumer Increase the requirement of a particular type of goods and services drastically supply of an important commodity decreases due to any reason Companies also generate high demands for one or more products due to frequent advertisements shown. The very relevant example we can take from the current scenario of Covid-19 is of sanitizers, masks, and disinfects. Due to the coronavirus pandemic, a sudden surge for the demand for these products was able to generate demand-pull inflation. In this case, all the companies benefited because they were able to sell these at very increased prices and consumers were ready to pay. Fiscal policyFiscal policy is the policy that the government adjusts to provide equilibrium into the economy by adjusting tax rates. If the government cuts the rates and left the discretionary income for consumers as well as industries then companies spend on new machinery, employee hirings, increased compensation, and the consumer will also buy more which leads to an increase in inflation. General effects of InflationInflation and InvestmentMy purpose to discuss all the above topics to make it easier for you to understand in terms of investment and correlation between inflation and investment. My motive is very clear that I want you to understand that if today you are able to buy bread at Rs 10 then tomorrow it would not be of the same price and of course the price would increase. Suppose today your monthly expenditure is of 50 K per month and you would retire after 20 years then to maintain the same cost of living you require much more money if we calculate at a very nominal inflation rate of 4% per year then you would be required 1 lakh per month and with the bank FD @ 5.5% after paying taxes you left with only 2%-3% depending upon the tax bracket. It is very clear that those who are at a fixed income group will suffer when their cost of living increases. If you talk about the stock market, then it is also not a defensive bet as to when inflation increased with the nominal rate the stock may perform well while if inflation rate surges very heavily then the stocks also slash. The stock market does not like changes and dilemmas and change creates the uncertainty that anything can happen in the future, some can have good effects while others may have a negative impact. Some others like the gold as investing tools to make themselves as inflation-proof. Luckily we can see that from the past 10 years the gold prices are continuously increasing but on the other hand, gold is not a very liquid asset as it will decrease the purchasing power of common man because trading very frequently in gold is not a game of a common man along with that, always there is risk associated of theft or managing problems if you are buying a manual form of gold. Money IllusionI find this very interesting as well as practical and have taken this from "The Intelligent Investor" of BENJAMIN GRAHAM There are two situations: If you receive a 2% salary hike every year and inflation runs at a rate of 4% If you receive a pay cut of 2% when the inflation rate is 00 Both the cases of your salary will leave you in an identical situation but you are comfortable with situation 1 rather than 2 as we all want to overlook the inflation, in return of that it takes away all our wealth. What is the best way that can opt to safeguard investors against increasing the inflation rate?I have studied so many books on it and after reading a lot, I come up with one conclusion that nothing alone is sufficient that can fight with inflation because future is always uncertain, we don't know what will happen today and maybe we are computing the things with 4% or 5% but maybe the inflation rate increases with the rate of 10% so we have to prepare ourself for every situation. An intelligent investor is only who safeguard his money from all the sides and appreciate his money day by day. the best way is diversification of your investment because everything cannot sink all together and if your money is diversified then if your money hurts from one side then the other will protect it for sure. Those investors are regular with their mutual fund's SIP they know that why people invest in hybrid funds. An investment portfolio should be divided into 5 segments to make your investment inflation-proof:

These 5 diversified segments will surely do wonders for your investment and the ratio between them depends upon the age of the investment. I am soon gathering all the information about the same and get back to you with the best out of it. |

Do you know your investment! Do you know your investment ! Investing is not only about money, but it is also about your emotions and hard work. If your investment is not fruitful and rewarding then you would not be motivated to do more hard work. A good and successful investment is like another earning member in your family who will take up your money, make your money work, and give you long-term returns. Investment is like buying today and consuming tomorrow, with an increase in quality and quantity. In other words, protecting our future and creating wealth. The purpose and meaning of investing can be different from person to person and profession to profession. Like the person earning 50k in a month, would be having a different investment objective, then the person earning 25k. Even their responsibilities would also play a vital role in investing, depending on their conditions, maybe the person earning 25 k is not having any major responsibilities while the person earns 50k ...

👍👍👍

ReplyDelete👍👍👍

ReplyDeleteVery nice blog..

ReplyDeleteVery nice blog .

ReplyDeleteGood informction

ReplyDeleteInflation is current process, we wants or not it leave it's effect on everyone of us. First we should study all the details giving above, than calculate it's effect to going through on further.

ReplyDeleteDiversifying the investment is only the only option...

ReplyDelete👍

ReplyDelete