|

| Financial statement Analysis-II |

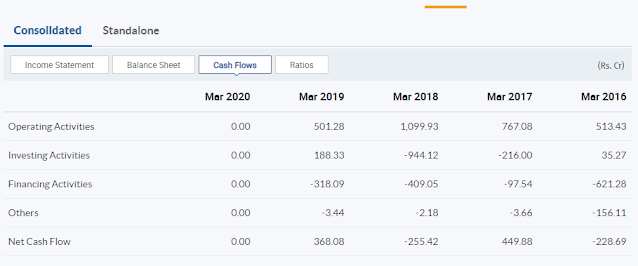

Financial statement Analysis-IIIn Financial statement analysis-I, we have studied two very important concepts, Profit and Loss Statement as well as Balance sheet, as these two factors play a vital role in the Financial statement analysis, there are another two concepts which are the heart of financial analysis, the one is cash flow analysis and other is ratio analysis, we will study it here one by one.Again I would like to confirm that here we are not going to learn any formulas/formats or the preparation of the accounting statements, as we are the users, not the creator so we just required to know the insight meaning and purpose of these statements as well as how we can reach to any conclusion before taking any rational decision about any company. Every report we are discussing is readily available on the internet. Also, read how to do Fundamental Analysis of the company. Cash flow StatementThe cash flow statement is prepared to tell you about the company's liquidity position, in other words, this is the statement to be prepared to provide the information that how much cash the company is generating and the amount of cash on which the company is sitting. This may raise a question that this information can't we get from profit and loss statement so you may have this answer from the below example: Mayank is the owner of Raymond's suitings and able to sell the fabric of approx Rs 10,000 daily, anybody is coming to his shop is paying full money for what they are buying so the amount of total sale is as same as the cash generated for that day. In this case, it is ok to only check the things with P&L account Suresh is the owner of a mobile store and selling all the top brands phones, he is able to sale near about 8 to 10 sets in a day and price of each let say of Rs 20,000 so he is able to make the sale of 200,000 in a day out which 6 mobiles sold on cash rest 4 sold on credit. So the sale has been done of Rs 2,00,000 but the cash he received only 1,20,000 so in this case you have to check both of your account, P & L as well as cash flow statement. So as now you understand the use of this statement now we, will move to the real-time example for better analysis : Above is the cash flow statement you can see of Havells India, data of 2020 is not yet revealed so we will analysis till 2019. Before we proceed to understand the method of analyzing the cash flow statement, we need to know all the activities required to perform in any company, let's say there is a company of furniture manufacturing so what all will be activities required to make it possible to run the company smoothly and successfully:

Now we will understand it by segregating these activities into 3 different parts: a) Operating Activities b) Investing Activities c) Financing Activities Operating Activity(OA):These are the activities that are related directly to the core operations of the company like, sales, advertisement, marketing, technology, manufacturing,up-gradation, etc. |

Investing Activity(IA):

These are the activities that are driven by any company to reap the benefit at later stages. For example, investing money in any startup company to make a big collaboration in later stages,

investing in equity shares of the company, investing in land, machinery, innovation, intangible and intangible assets.

Financing Activities(FA) :

Cash flow from financing activities is the section where all the activities related to financial terms to be noted, for example, related to dividend, raising of funds or debts, issuing of bonds certificates, adding or changing loans.

Now, we can divide each of these activities as follows so that we can understand the inflow and outflow of cash into the company:

- Advertising(OA)

- Manufacturing(OA)

- Buying upgrade machines(OA)

- hiring managers/staffs(OA)

- Taking loans from the bank(FA)

- activities involved in innovation and designing of new products(IA)

- Encouraging the issue of fresh capital(FA)

- Investing in building up-gradation and space enlargement(IA)

Each of the activities can have either inflow or outflow of cash so think the impact of the above transactions onto the cash balance of the company and how it is treated in the balance sheet of the company.

Particular | Expenses for Advertisement

Balance sheet treatment| Treated as an asset

Type of activity | (OA)

The effect over cash balance of the company| Cash inflow Decreased

Particular | Buying upgrade machines

Balance sheet treatment| Treated as an asset

Type of activity | (IA)

The effect over cash balance of the company| Cash inflow Decreased

Particular | Manufacturing expenses

Balance sheet treatment| Treated as an asset

Type of activity | (IA)

The effect over cash balance of the company| Cash inflow Decreased

Particular | Highering of managers/staffs

Balance sheet treatment| Treated as an asset

Type of activity | (OA)

The effect over cash balance of the company| Cash inflow Decreased

Particular | Taking loans from the bank

Balance sheet treatment| Treated as a liability

Type of activity | (FA)

The effect over cash balance of the company| Cash inflow Increased

Particular | activities involved in innovation and designing of new products

Balance sheet treatment| Treated as an asset

Type of activity | (IA)

The effect over cash balance of the company| Cash inflow Decreased

Particular | activities involved in innovation and designing of new products

Balance sheet treatment| Treated as an asset

Type of activity | (IA)

The effect over cash balance of the company| Cash inflow Decreased

Particular | Encouraging issue of fresh capital

Balance sheet treatment| Treated as liability

Type of activity | (FA)

The effect over cash balance of the company| Cash inflow Increased

Particular | investing in building up-gradation and space enlargement

Balance sheet treatment| Treated as an asset

Type of activity | (IA)

The effect over cash balance of the company| Cash inflow Decreased

Now we can take the above cash flow statement of Havells:

Operating activities are mainly checked in the cash flow statement we can see that in Havells India in 2019 the operating activities are showing 501.28 crore which implies that the company generates this much from its business operations. We can compare this as well from previous years' figures.

Negative Net cash flow is not good for the company, as it implies that more outgoing of money than its incoming.

Here we check the brief of all the explanation:

Negative Operating Activities impact: Operating activities include day to day activity of the business or the basic operations required to run the business, negative figures from this can be the result of stress as the money expended on operating activities are unable to generate an inflow of money into the business.

Positive Operating Activities impact: Cash expenditure operating activity is able to generate cash inflow.

Negative Investing Activities impact: Investing activities are very important for growth and capital of business, It is good when business is investing a lot for future gains while it can be a warning sign if a company made a poor asset purchasing decision and you can only get this information if regularly company is showing negative cash flow from investing activity.

Positive Investing Activities impact: It is a positive impact on the company that they are able to generate cash from its investing activity

Negative Financing Activities impact: Financing activity means the net amount of funding a company generates in a specifies period which is used to finance the company, while negative financing activity can also be good or bad, good when a company distributes more dividend to its shareholders or done the expenditure over fundraising plan or paid long-term debts, bad in the sense that company is raising a lot of borrowings to run its operating activity.

Positive Financing Activities impact: More money is flowing into the company rather than outflow.

This is very much important for every investor that he/she should read and understand financial analysis concept and terminology before deciding where they can put their hard-earned money for fruitful investment. Here you can check the lessons that you can learn from the previous multi beggar stocks.

Ratio Analysis

Ratio analysis is one of the most important tools and powerful tools of financial statement analysis and with the help of this analyst able to take more rational and correct decisions about any company or its stock. After calculating the result of one ratio or two ratios, we cannot interpret the result correctly, We should check all the ratios before to reach any final conclusion, ratio analysis can tell you about the financial position of the company to the great extend.

Classification of Ratios are as follows:

a) Earning Per-share ratio

a) Liquidity Ratio

b) Long-term solvency ratio

c) Profitability ratio

d) Activity or turnover ratio

e) Leverage or capital ratio

In this, I would be discussing each of these ratios in very simple terms so that you could have an idea of each of them. Moreover, we will discuss each one of them separately in detail with proper examples in separate blogs for your better understanding.

Earning per share ratio:

As we already studied in detail that what is EPS in P.E Ratio post. Earning per share tells you the profitability of the company and as much high, the EPS ratio is, the company would be able to generate more dividends and growth for its investors.

Liquidity ratio:

Liquidity ratio defined as the companies ability to pay its liabilities and debts and if any company holds a liquidity ratio greater than 1 then it is good.

Long-term solvency ratio:

Long-term solvency ratio defined as the companies creditworthiness to pay its longterm obligation. A higher ratio is the company capable enough to cover its liabilities in the long-run.

Profitability ratio:

Profitability ratios measure the overall condition of the company. A higher ratio indicates that the company is generating positive returns.

Activity or turnover ratio:

Activity ratio as the name suggests that it is the ability to check the efficiency of various operations of the firm or we can explain that what is the speed of its operations that the assets of the company can be converted into sales, The higher the activity ratio is the better is the company is performing.

Leverage or capital ratio:

This ratio tells the company holding the debts or debt funds with them. This is very important to know for every investor that how much debt the company holds and this ratio should not be more than 0.5 means that any company should not hold more than half of its assets financed by debts.

There are much idea readers and investors have received about self-analysis of any company before investing, I can be sure that if you would be able to do this much of analysis for any company before investing then you would be able to preserve your invested money and can also generate very good returns with patience.

Good topic .

ReplyDeleteNice

ReplyDeleteAppreciable task... 👌👍

ReplyDelete